The Reserve Bank has been mandated to maintain price stability, keeping in mind the objective of growth. Price stability has been numerically defined as maintaining a headline CPI inflation target of 4.0 per cent with a tolerance band of +/- 2 per cent.

Published Date - 07:23 PM, Tue - 5 September 23

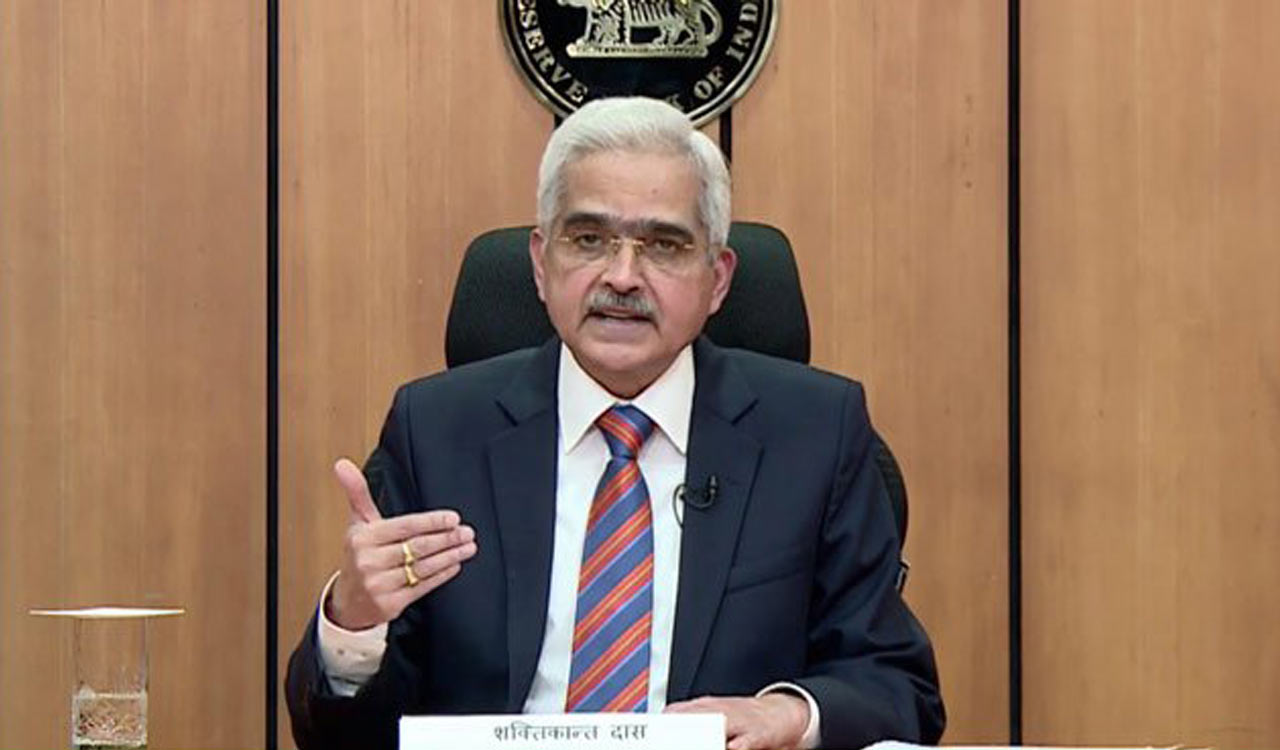

New Delhi: Reserve Bank Governor Shaktikanta Das on Tuesday said the central bank is firmly focused on bringing down inflation to 4 per cent and remains prepared to undertake policy responses to deal with supply shocks, which have become more frequent with profound implications.

The current episode of high global inflation and preceding overlapping shocks of the pandemic and Russia-Ukraine war have raised significant issues and challenges for the conduct of monetary policy, the governor said in a speech on ‘Art of Monetary Policy Making: The Indian Context’ at Delhi School of Economics (DSE) Diamond Jubilee Distinguished Lecture.

He said the monetary policy framework in India has evolved in line with the developments in theory and country practices, the changing nature of the economy and developments in financial markets. Within the broad objectives, the relative emphasis on inflation, growth and financial stability has, however, varied across monetary policy regimes since independence.

Das listed out steps the central bank took to deal with the situation created in the wake of the COVID pandemic and the Russia-Ukraine war.

Following the outbreak of the war, the central bank raised the policy rates by 250 basis points since May 2022.

“After a near-zero policy rate for a prolonged period, central banks in these (advanced) economies started raising interest rates aggressively in 2022, which contributed to stress in certain banks in these economies. In contrast, our battle against inflation is not constrained by financial stability concerns. In fact, even during the COVID phase, we continuously took measures to strengthen financial stability,” the governor said.

The Reserve Bank, he said, has adopted a prudent approach and taken several initiatives to revamp the regulation and supervision of banks, NBFCs and other financial entities by developing an integrated and harmonised architecture.

“Our banking system remains resilient and healthy with improved capital ratios, asset quality and profitability,” he said.

Das said the RBI‘s experience in recent years shows that supply shocks have become more frequent with profound implications for inflation management and anchoring of inflation expectations. A key risk of sustained high inflation is that it can de-anchor inflation expectations.

“It is, therefore, important to remain vigilant and take necessary steps in a calibrated and timely manner to keep expectations firmly anchored.

“The Reserve Bank has been quick and calibrated while navigating through such turbulences. We look through fleeting shocks but remain prepared to undertake policy responses if such shocks show signs of persistence and getting generalised,” he said.

In such a scenario, monetary policy has to focus on containing the second-round effects, the governor added.

“We will remain watchful of this also. The role of continued and timely supply-side interventions, as being undertaken by the government, assumes criticality in limiting the severity and duration of such food price shocks.

“In these circumstances, it is necessary to be watchful of any risk to price stability and act timely and appropriately. We remain firmly focused on aligning inflation to the target of 4.0 per cent,” he added.

Headline inflation based on the Consumer Price Index (CPI) had eased to 4.8 per cent in June 2023 from the peak of 7.8 per cent in April 2022. It, however, surged to 7.4 per cent in July, mainly on account of a spurt in vegetable prices, which have already started moderating.

Das noted that low and stable inflation helps households and businesses in planning for long-term savings and investments, which ultimately drive innovation, productivity and sustainable growth.

On the contrary, high and volatile inflation corrodes the economy by denting productivity and the long-term growth potential, he said, adding inflation also imposes a disproportionate burden on the poor.

The Reserve Bank has been mandated to maintain price stability, keeping in mind the objective of growth. Price stability has been numerically defined as maintaining a headline CPI inflation target of 4.0 per cent with a tolerance band of +/- 2 per cent.

The tolerance band provides flexibility to accommodate growth and financial stability concerns, supply shocks and measurement and forecast errors, Das said.

The target is set by the government in consultation with the Reserve Bank for 5 years.

Leave a Reply