The objective should be to minimise revenue loss, thereby addressing the valid concerns of States as they relinquish a significant source of fiscal autonomy

Published Date – 11:45 PM, Thu – 12 October 23

By Santosh Kumar Dash, Sidharth R

When the Goods and Services Tax (GST) was launched on July 1, 2017, debates surrounding the dynamics of a unified digital indirect tax were multifaceted. The concerns of States relinquishing taxing powers to the GST Council, alongside the union government’s veto power, revolved around potential revenue loss in transitioning from the old multi-tax system.

To allay such apprehensions, the Centre promised compensation if the GST revenue fell short of 14% compound growth on States’ 2015-16 indirect tax revenue. Compensation was funded by a cess on luxury goods, stabilising States’ revenue in the initial five years. The pandemic complicated the transition and led to a huge revenue shortfall. Even though there was a strong demand by States to extend the compensation, the compensation ended in June 2022 as mandated in 2017.

Fortunately, one year after the non-extension of the GST compensation, GST collections have been steadily growing since the last fiscal year. Post-pandemic, the revenue has been growing consistently every month. The average monthly gross GST collection in FY24 stands at Rs 1.65 lakh crore with an 11% year-on-year growth compared with the corresponding period last fiscal. April 2023 recorded an all-time high GST collection of Rs 1.87 lakh crore, 12% higher than last April. The Ministry of Finance data shows an average monthly GST collection of Rs 0.94 lakh crore, Rs 1.23 lakh crore and Rs 1.5 lakh crore in fiscal years ending 2021, 2022 and 2023. Fiscal 2021-22 clocked a 30% revenue growth, while 2022-23 exhibited a 22% growth. The average collection in this fiscal is Rs 1,67,682 crore, reflecting a significant upward trend in national-level GST collection.

State-level Collection

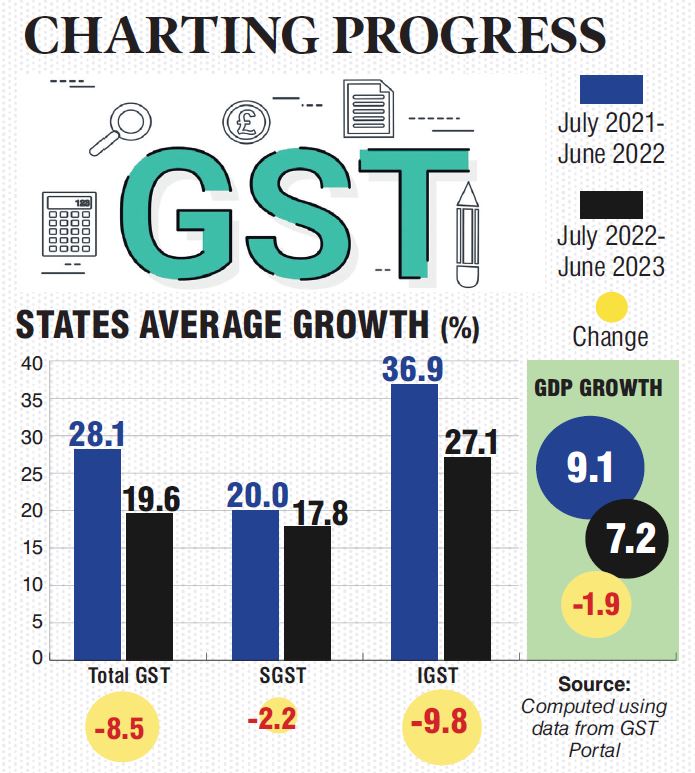

Almost all States recorded their highest annual growth in the 2021-22 GST year (July to June). The total GST (TGST) revenue, which includes both SGST and Integrated GST settlements allocated to each State, also saw its peak growth in the 2021-22 GST year (averaging 28%). This growth came from increased compliance, higher growth, a post-pandemic surge in domestic consumption and partially from higher inflation. The average TGST revenue of States in GY23 (2022-23 GST year) was 19.6%, much higher than the 14% projected growth rate. Several factors contribute to this robust growth, such as improved buoyancy, stability in the GST platform, utilisation of data analytics which improved auditing and supervision, and prompt action against the GST offenders.

However, compared with GY22, the GST growth moderated in GY23 due to a dip in GDP growth from 9.1% in FY22 to 7.2% in FY23, highlighting the diminishing impact of pent-up demand. A similar story emerges for SGST and IGST settlement collections. IGST is levied on all inter-State supplies of goods and/or services or across two or more States/Union Territories). Data suggests that the primary driver behind States’ total GST revenue growth has been the substantial increase in IGST settlement. The average annual growth of SGST revenue for States in GY23 stood at 17.8%, down from 20% in GY22. The IGST settlement also showed the highest growth in GY22, with an average growth of 36.9% and declined to 27.1% in GY23.

Post Compensation

The RBI report on State Finances-2023 highlighted the adverse effects of discontinuation of GST compensation on State finances. Puducherry, Punjab, Delhi, Himachal Pradesh, Goa and Uttarakhand would be particularly impacted as their compensation exceeded 10% of average tax revenue, it stated. The report also opined that the fiscal outlook of States remains favourable as their gross fiscal deficit is projected to reach 3.4% in 2022-23 against a high 4.1% of GDP in 2020-21. A report by the Bank of Baroda estimates the actual gross fiscal deficit to be 2.9% of GDP, well above the projected 3.4%. This would mean that the withdrawal of GST compensation has not gravely affected the States as they received GST compensation for only one-quarter of the fiscal year. But the report also points out that the budgetary forecast of the average fiscal deficit for the current fiscal is 3.2% which can be due to slower global growth and also higher spending owing to impending Assembly elections.

The share of fiscal deficit financed through market borrowing has decreased after the pandemic year of 2020-21 when 80% of States’ fiscal deficits were funded using market borrowings. The figure dipped to 75% in 2021-22 and to 69% in 2022-23 fiscal even with GST compensation being absent for three quarters, reflecting a good fiscal consolidation performance of the States. Nevertheless, the discontinuation of compensation has led to a sacrifice in capex spending that does not bode well for the economy as it is counterproductive to growth.

Sustaining Momentum

Mandatory e-invoicing for smaller businesses (Rs 5 crore turnover from August) is set to bolster growth. The preceding discussion about revenue performance underscores a crucial point: the growth of GST has gained significant momentum and possesses the resilience to endure short-term challenges to facilitate the implementation of next-generation reforms. Utilising data analytics, continuous fraud vigilance and improved auditing would enhance revenue buoyancy.

Revenue flow would improve further, providing an opportunity to implement pending GST reforms like rate rationalisation, minimising product classification across rates and a broader tax base. Approximately half of the CPI (Consumer Price Index) basket items remain outside the GST purview.

Elevating the weighted average GST rate, which dropped from 14.4% (July 2017) to about 11,.6% as per The Fifteenth Finance Commission report is vital. This will further propel GST revenue. While raising average tax rates should be a long-term reform considering that this will be politically and economically difficult, the discussion must start at the earliest.

The process of raising weighted average tax rates and rate restructuring should be executed in a manner that it paves the way for the inclusion of commodities kept outside the GST, such as fuel products and electricity. As they get subsumed into GST, the objective should be to minimise the revenue loss, thereby addressing the valid concerns of States as they relinquish a significant source of fiscal autonomy. Thus, undertaking the pending second-generation GST reforms is a luxury that neither the union nor the States can readily afford. But the opportune moment has arrived, and let us seize this growth momentum to secure the future of GST.