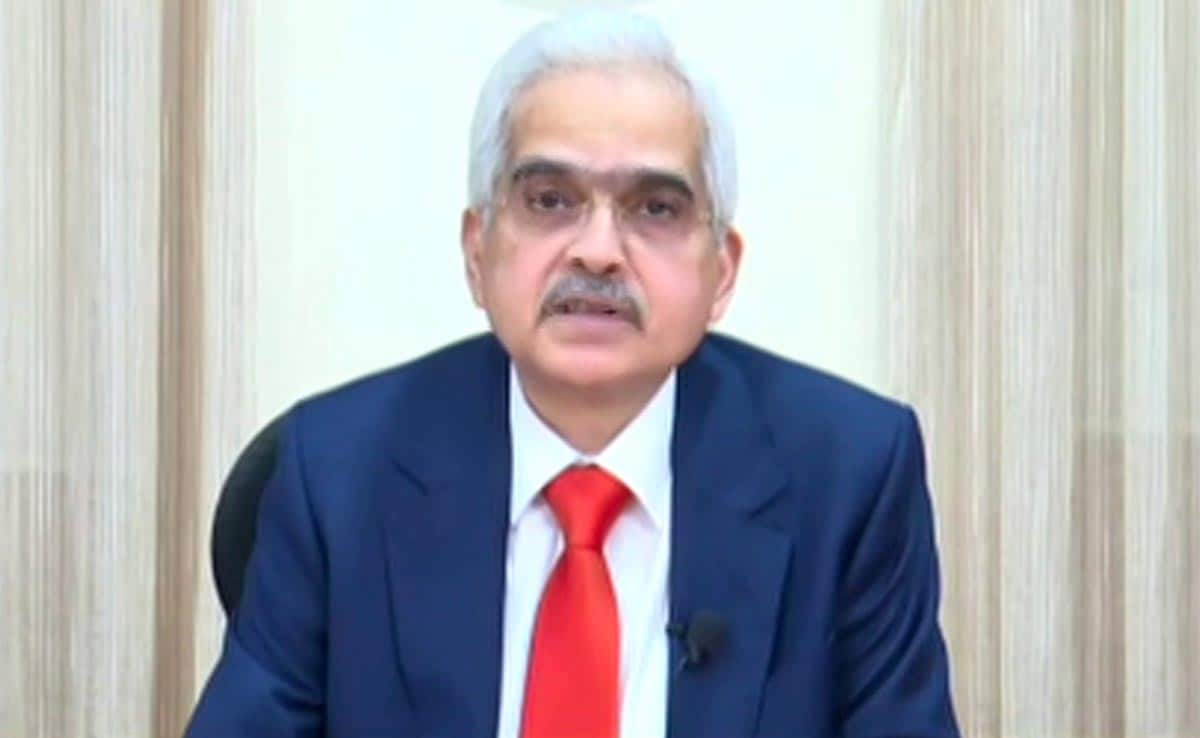

RBI Monetary Policy: The RBI Governor said retail inflation is likely to be 5.4% for this financial year.

Mumbai:

The Reserve Bank of India (RBI) today decided to keep its key lending rate unchanged at 6.5% for the fourth consecutive time. The decision was taken unanimously at the central bank’s bi-monthly Monetary Policy Committee (MPC) meeting, said RBI Governor Shaktikanta Das.

This means the loan interest rates too are likely to remain unchanged.

The RBI Governor said inflation is likely to ease in September, but added that that overall outlook is clouded by uncertainties. The retail inflation is expected to be 5.4% for the current financial year and reduce to 5.2% in the next fiscal, Mr Das said.

However, food inflation may not see sustained easing in the current October-December quarter, added the RBI Governor.

The MPC meeting was held in the backdrop of inflation touching 6.83% in August. The figure for the current month is expected next week. The government has mandated the central bank to keep retail inflation at 4% with a margin of 2% on either side.

“The monetary policy should be in absolute readiness to tackle sudden food and fuel price rise,” said Mr Das, adding that domestic economy has exhibited resilience on back of strong demand.

The RBI also retained the GDP growth forecast for the current financial year at 6.5% as the Governor said India is poised to become new growth engine of world.

The banking system continues to be resilient on back of improved asset quality, said Mr Das, adding that the central bank may have to consider open market operation for government securities to manage liquidity.

NDTV is now available on WhatsApp channels. Click on the link to get all the latest updates from NDTV on your chat.