Currently, EV car dealers in Telangana are deducting the road tax amount from the total price of the vehicle. In fact, they are using the tax amount as an incentive to attract customers

Updated On – 11:03 PM, Sun – 17 December 23

Hyderabad: Electric car sales, which saw a substantial drop after the State government withdrew the lifetime road tax and registration fee exemption enjoyed by electric passenger cars in July, are once again picking up with EV car manufacturers and dealers deciding not to pass on the tax amount to customers. The government has replaced the exemption from paying road tax for electric cars with a fee that ranges from 11 to 15 percent.

Currently, EV car dealers in the State are deducting the road tax amount from the total price of the vehicle. In fact, they are using the tax amount as an incentive to attract customers. The customers are saving amounts ranging between Rs.1.6 lakh to Rs.2.5 lakh (Under Rs. 15 lakh vehicle cost) depending upon the cost of the car.

According to Jasper Industries Private Limited (Secunderabad branch) sales manager K Venkatesh, after the State government withdraw the road tax exemption, the sale declined a lit bit between July and September, but once dealers started deducting the road tax amount during Dasara, the sales picked up. “Tata Motors used to sell 300 EV cars in a month before the government withdrew the road tax exemption. Now we are selling about 250 cars every month. We are expecting it to go up this month,” he said.

Since the government was continuing the exemption given to commercial electric vehicles, the sale in that sector has been constantly on rise, he said. “We are selling about 500 commercial EVs every month in the State,” he said.

However, he stated that the State government should continue the road tax exemption as it would help both customers and dealers. “If dealers and manufacturers continue to absorb the road tax amount, they will suffer huge financial losses in the long run,” he said.

Even other electric car dealers in the city are of the opinion that the State government should reconsider its decision and exempt EV cars from road tax.

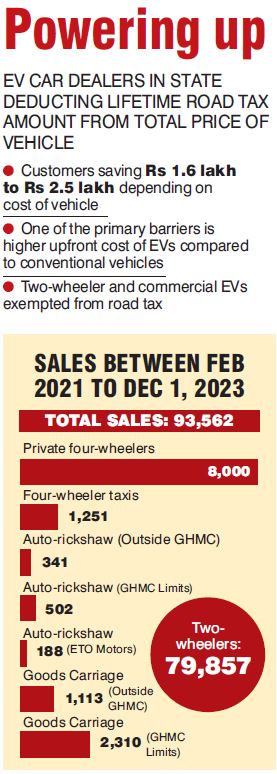

As per data available with the Transport Department, as many as 93,562 Electric Vehicles were sold in the State between February 2021 to December 1, 2023. Of these, 92,108 EVs were sold in the Greater Hyderabad Municipal Corporation (GHMC) districts and the rest were sold in the non-GHMC districts.

So far about 79,857 electric two wheelers, 8,000 private four wheelers, 1,251 taxis, 502 EV auto-rickshaws in GHMC limits and 341 in non-GHMC limits,188 ETO motors auto-rickshaws and 2,310 Goods Carriages in GHMC limits and 1,113 in non-GHMC limits have been sold in the State.

According to Transport Department officials, the demand for electric vehicles has been on the rise in the State and it has been picking up every passing day. “Due to the increase in the prices of petrol and diesel, the use of electric vehicles is seen as an alternative. A lot of people are now opting for EVs, especially two wheelers,”an official said. On December 1 alone, 167 EVs were sold in the State, he pointed out.

The Telangana Electric Vehicle & Energy Storage Policy 2020-2030, has propelled the faster adoption of EVs in the State as it offered 100 per cent exemption of road tax and registration fees for the first 2 lakh electric two-wheelers and 5,000 electric cars purchased and registered within the State. This made electric vehicles an attractive option for consumers looking to reduce their overall ownership costs.

According to market observers, one of the primary barriers is the higher upfront cost of electric vehicles compared to conventional vehicles and the cost of batteries, which constitutes a significant portion of an EV’s price, remains relatively high. This price differential makes EVs less affordable for many consumers, especially in a price-sensitive market like India, a dealer said.