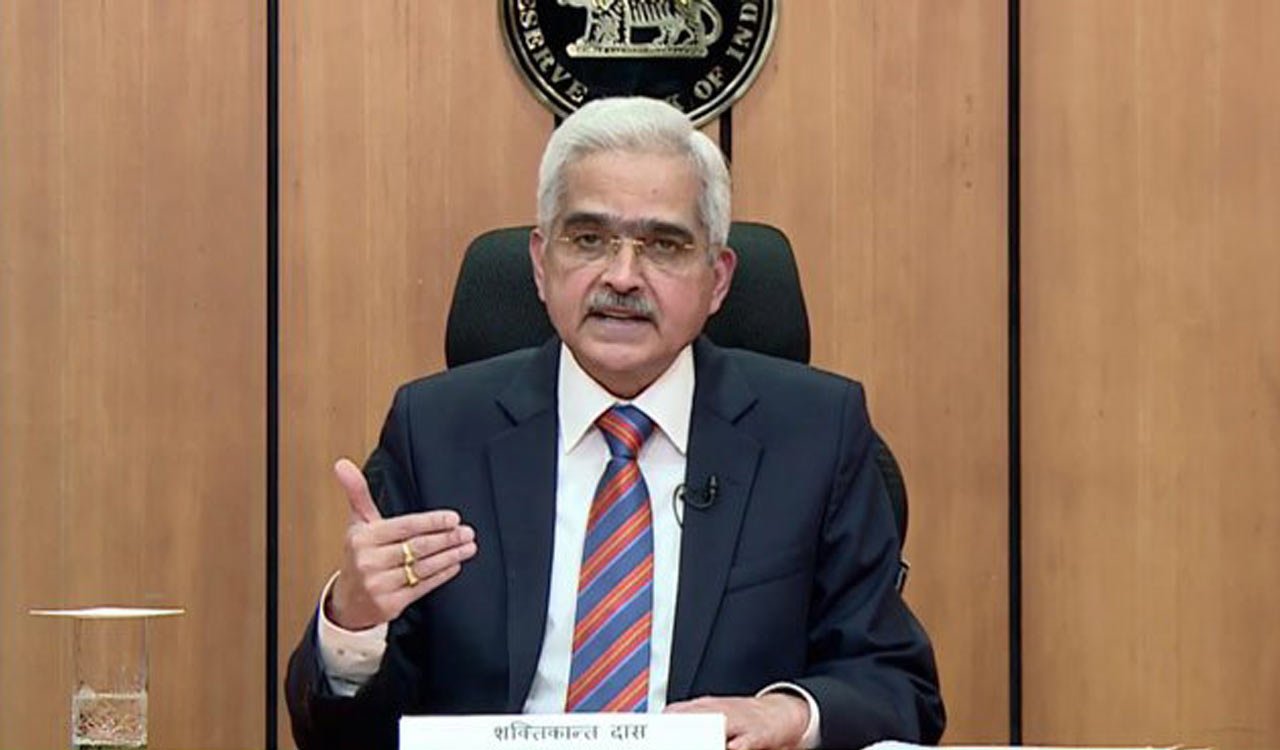

Governor Das Addresses Delhi Gathering, Notes Economic Complexity and Strong Dollar Index

Published Date – 02:17 PM, Fri – 20 October 23

New Delhi: Reserve Bank of India (RBI) Governor Shaktikanta Das addressed concerns about India’s financial stability, crude oil prices, and rupee volatility in a recent statement, emphasizing the stability of the Indian Rupee amidst global economic fluctuations.

Addressing a gathering in Delhi, Governor Das highlighted the complexity of the current economic landscape, stating, “There is a multiplicity of factors. The dollar index has become quite strong. The bond yields in the US have reached an all-time high, but, if you look at the volatility of the Indian rupee from January 1 this year till now, the rupee depreciation is 0.6 per cent. Whereas on the other hand, the appreciation of the US dollar for the same period has been in the order of about 3 per cent. So the rupee is stable.” Governor Das reiterated the robustness of India’s financial sector, emphasizing that despite new uncertainties emerging in the past fortnight and fluctuations in crude oil and bond markets, India’s economic fundamentals remained sound.

He underscored the RBI‘s vigilance, especially in managing retail inflation, and clarified that the central bank was not considering the re-introduction of the Rs 1000 denomination.

Regarding the availability of currency notes, sources confirmed that existing denomination notes were sufficient to meet the current demand.

Governor Das stated, “Most of the Rs 2000 notes came back to RBI, rest are coming, only Rs 10,000 crores left.” He emphasized that the RBI was in the market to prevent excessive volatility and maintain the stability of the Indian Rupee.

Additionally, Governor Das addressed concerns about high-interest rates, stating that the RBI’s prime objective was a gradual reduction in rates.

He highlighted the importance of petrol and diesel prices, indicating the central bank’s vigilance in managing these aspects of the economy.

On the sidelines of the event, experts echoed Governor Das’ sentiments, affirming the stability of the Indian Rupee.

They noted that the rupee’s depreciation had been only 0.6 per cent against the dollar since January 1, while the appreciation of the USD during the same period was around 3 per cent.

This stability reassured the markets and demonstrated the RBI’s proactive measures to maintain equilibrium amidst global economic fluctuations.

As India navigates these economic challenges, the RBI’s cautious approach and proactive interventions are expected to play a pivotal role in ensuring the country’s financial stability and economic resilience.