Benchmark equity indices declined on Thursday post the RBI monetary policy, dragged down by banking counters

Published Date – 06:00 PM, Thu – 10 August 23

Mumbai: Benchmark equity indices declined on Thursday post the RBI monetary policy, dragged down by banking counters, after the unexpected announcement of reducing cash in the financial system.

Investors also remained on the sidelines ahead of the US inflation data announcement.

The Reserve Bank of India (RBI) on Thursday left its key interest rates unchanged for a third straight meeting but signalled tighter policy if food prices drive inflation higher.

The monetary policy committee, which has three members from the central bank and a similar number of external members, held the benchmark repurchase rate (repo) at 6.50 per cent in a unanimous decision.

It retained the stance on “withdrawal of accommodation” but Governor Shaktikanta Das sounded hawkish when he highlighted that headline inflation needs to subside sustainably below 4 per cent and any surge in the inflation print, if continued for a longer period, may necessitate fresh action.

The 30-share BSE Sensex fell 307.63 points or 0.47 per cent to settle at 65,688.18. During the day, it tanked 486.67 points or 0.73 per cent to 65,509.14.

The NSE Nifty declined 89.45 points or 0.46 per cent to end at 19,543.10.

“RBI kept the policy rate unchanged at 6.5 per cent with a stance ‘withdrawal of accommodation’ while supporting growth. The market participants would have ideally wanted a less hawkish undertone but the governor sounded cautious in his address,” said Srikanth Subramanian, CEO, Kotak Cherry.

From the Sensex pack, Asian Paints, Kotak Mahindra Bank, ITC, Bharti Airtel, Axis Bank, ICICI Bank, Nestle, Tata Motors, HDFC Bank, HCL Technologies, Maruti and Hindustan Unilever were the major laggards.

IndusInd Bank, JSW Steel, Titan, Bajaj Finance, Tech Mahindra and Power Grid were among the gainers.

“While RBI’s status quo on interest rate didn’t come as a surprise, the MPC’s cautious tone and no signal of any rate cut by this year end hurt the market sentiment. Inflation continues to be the key concern area and the RBI remaining watchful of the developments in key global economies indicates that investors’ appetite for equities will be measured in the near to medium term. Also, investors kept a low profile ahead of the US inflation data to be released later today,” said Shrikant Chouhan, Head of Research (Retail), Kotak Securities Ltd.

In the broader market, the BSE smallcap gauge declined 0.15 per cent and midcap index fell 0.09 per cent.

Among the indices, telecommunication declined by 1.05 per cent, FMCG fell by 0.88 per cent, bankex (0.81 per cent), financial services (0.61 per cent), IT (0.33 per cent), realty (0.25 per cent), teck (0.19 per cent) and commodities (0.18 per cent).

Energy, utilities, consumer durables, metal and power were among the gainers.

The hawkish stance was also reinforced by the unexpected announcement of reducing the cash in the banking system by raising the incremental cash reserve ratio (ICRR) to 10 per cent on the incremental NDTL (net demand and time liabilities) over the last 3 months. This will help in absorbing a large part of the excess liquidity created through the return of the Rs 2,000 notes and the large dividend to the government from RBI.

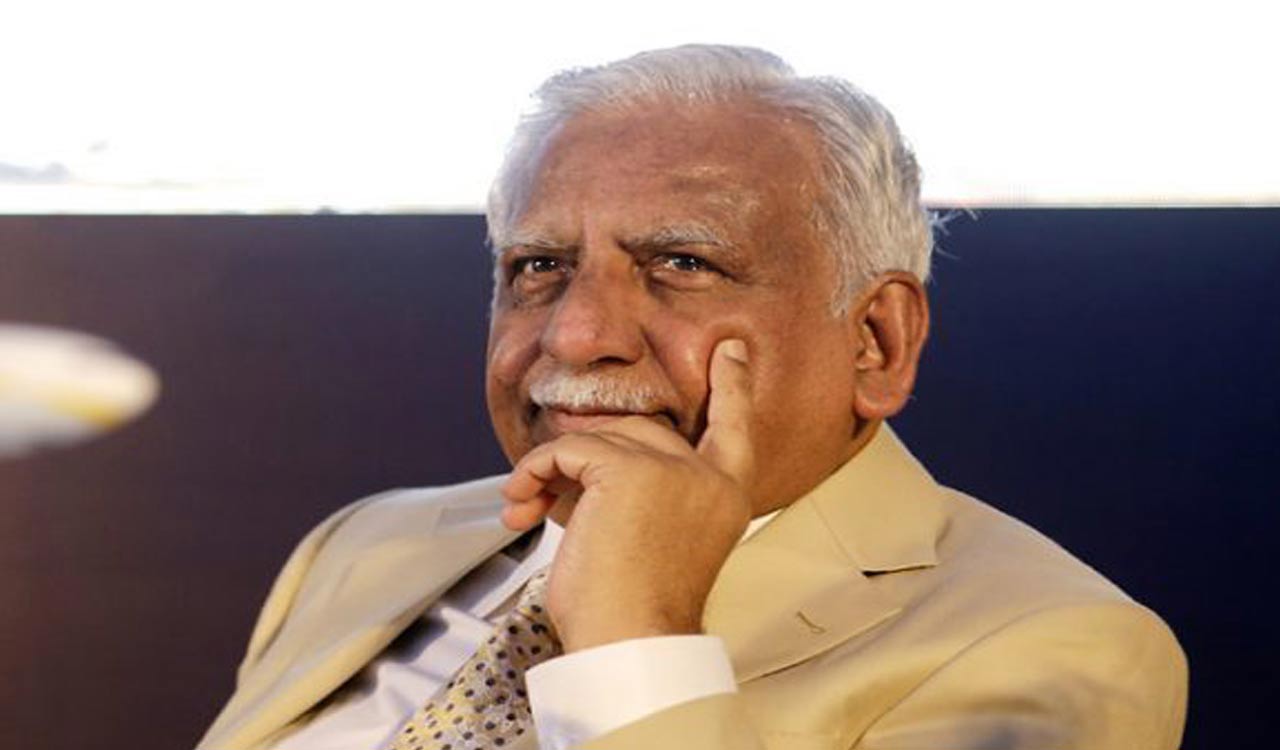

“The stock market was taken by surprise by RBI’s action to remove excess liquidity from the system, due to the influx of Rs 2,000 bank notes, among other factors,” Amar Ambani, Group President & Head – Institutional Equities, YES Securities (India) Limited, said.

In Asian markets, Tokyo, Shanghai and Hong Kong settled in the green, while Seoul ended lower.

European markets were trading in the green. The US markets ended in the negative territory on Wednesday.

“Inflation concerns have resurfaced in the domestic market after the RBI elevated their CPI forecast by 30 basis points to 5.4 per cent, thereby increasing the chances of a protracted rate cut trajectory. Furthermore, the RBI’s move to control liquidity through incremental CRR dented the sentiments of the banking sector, although the impact is projected to be limited.

“Against this backdrop, investors will be closely watching the US inflation print today and the domestic inflation data on Monday,” said Vinod Nair, Head of Research at Geojit Financial Services.

Foreign Institutional Investors (FIIs) turned buyers on Wednesday after continuous offloading of equities for the past several days. They bought equities worth Rs 644.11 crore on Wednesday, according to exchange data.

Global oil benchmark Brent crude climbed 0.05 per cent to USD 87.59 a barrel.

The BSE benchmark had climbed 149.31 points or 0.23 per cent to settle at 65,995.81 on Wednesday. The Nifty gained 61.70 points or 0.32 per cent to end at 19,632.55.