New Delhi: Shares of Tata Group companies on Thursday rose up to 10 per cent, with Tata Chemicals and Tata Teleservices among the major gainers. Tata Sons Chairman Emeritus Ratan Tata, who played a key role in transforming the group into a global conglomerate, passed away late on Wednesday. He was 86. “Investors can pay […]

Published Date – 10 October 2024, 03:00 PM

New Delhi: Shares of Tata Group companies on Thursday rose up to 10 per cent, with Tata Chemicals and Tata Teleservices among the major gainers.

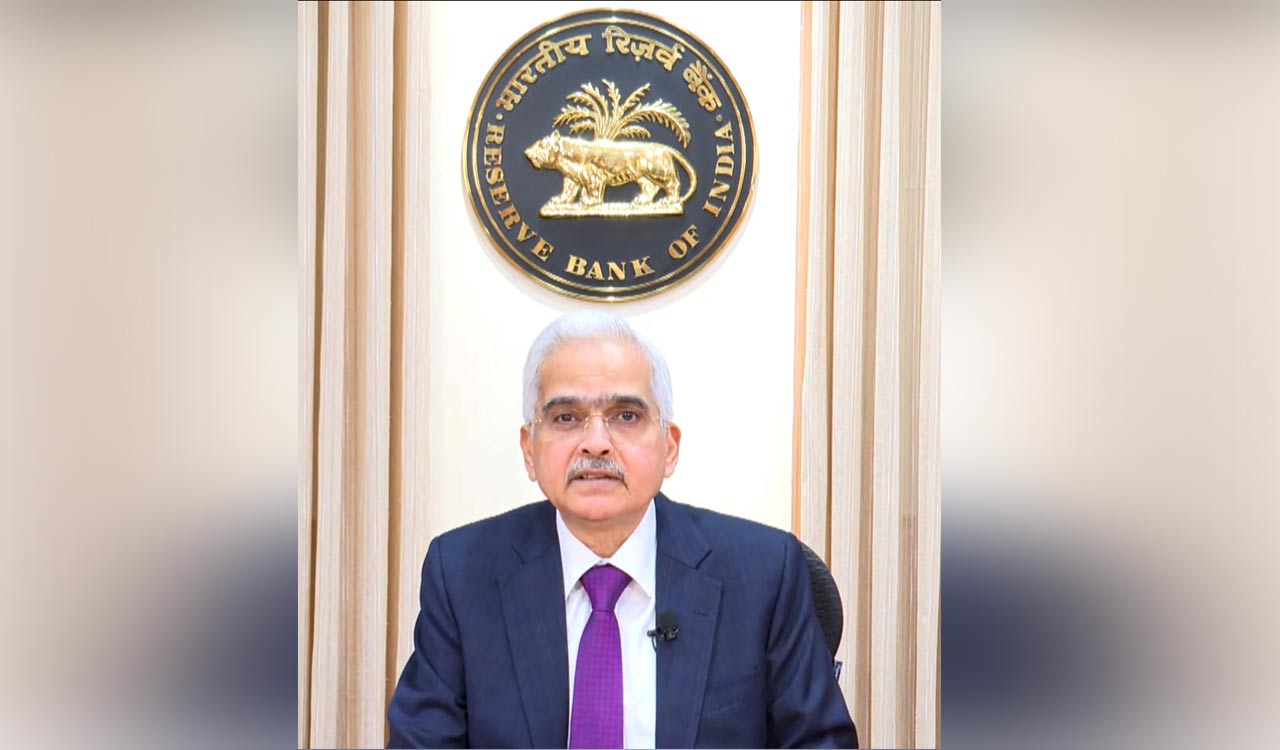

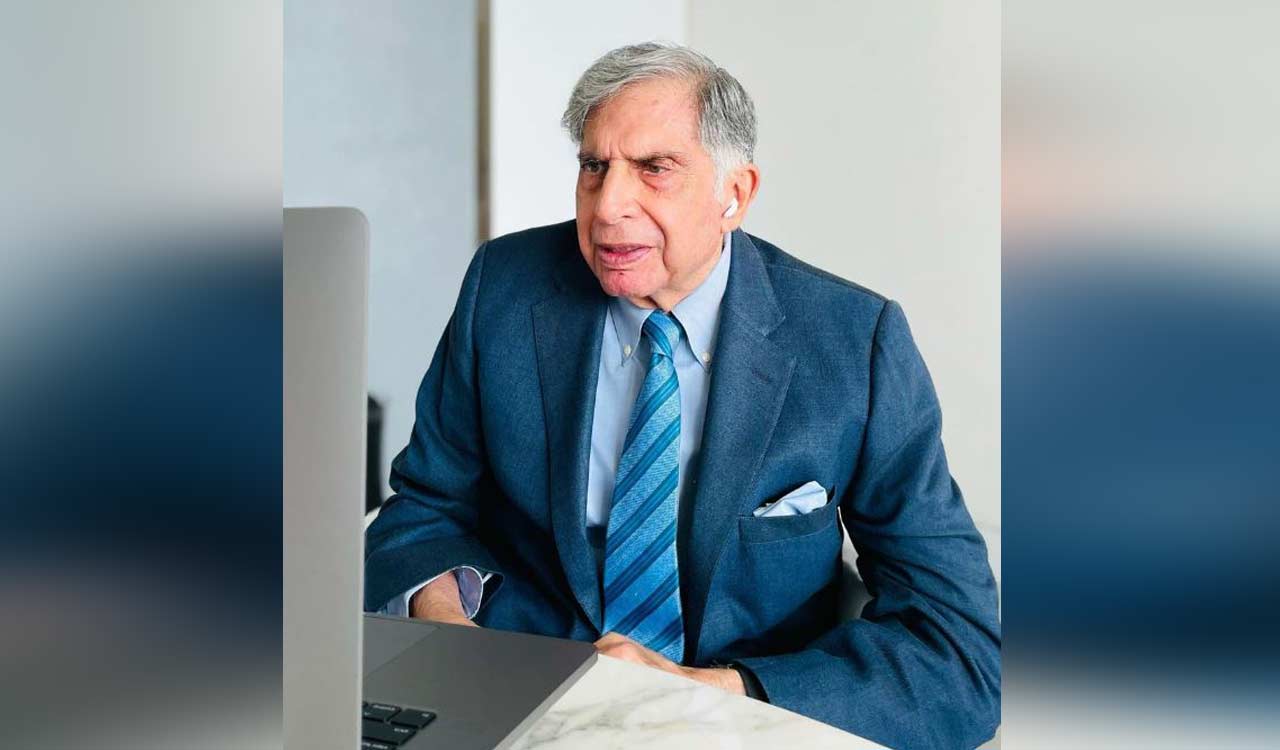

Tata Sons Chairman Emeritus Ratan Tata, who played a key role in transforming the group into a global conglomerate, passed away late on Wednesday. He was 86.

“Investors can pay tribute to Ratan Tata and the great corporate empire he built by buying stocks like TCS, Tata Motors, Tata Steel, Tata Consumer and Indian Hotels.

“Ratan Tata, while pursuing the group’s growth, contributed substantially to India’s growth and millions of ordinary investors gained from the great man’s vision,” V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services, said.

The stock of Tata Investment Corporation soared 10.47 per cent to trade at Rs 7,235.80 apiece, Tata Chemicals climbed 6.26 per cent to Rs 1,174.85, Tata Teleservices Maharashtra jumped 5.84 per cent to Rs 83.77, Tata Elxsi rose 3.37 per cent to Rs 7,867.80, Tata Power went up 2.56 per cent to Rs 472.70 on the BSE.

Also, shares of Tata Technologies, Rallis India, Nelco, Tejas Networks, TajGVK Hotels & Resorts, and Indian Hotels & Company also rose on the bourse.

In addition, the scrip of Tata Steel rose 0.91 per cent, Tata Communications (0.84 per cent), Tata Consultancy Services (0.21 per cent), Tata Consumer Products (0.17 per cent), Voltas (0.24 per cent) and Automotive Stamplings & Assemblies (0.23 per cent) on the BSE.

However, Tata Group’s retail firm Trent slipped 0.90 per cent to trade at Rs 8,146.35 apiece, Titan fell 0.81 per cent to Rs 3,465.80 and Tata Motors was down 0.40 per cent to Rs 935.35 per scrip.

The 30-share BSE Sensex jumped 198.28 points, or 0.24 per cent, to 81,665.38 in the mid-session trade on Thursday.

Investors should learn from the growth of the Tata empire that a long-term investment horizon is required to really participate in the wealth creation that happens through the capital market. In a bull market like the present one, there will always be valuation concerns, Vijayakumar added.

Tata Consultancy Services (TCS) has cancelled a press conference scheduled on Thursday evening to announce its second quarter performance, company officials said.

The press conference was originally scheduled at 1730 hours on Thursday.

As originally scheduled, TCS will inform the exchanges about its July-September performance after the board meeting, the officials said.

A scheduled call with analysts at 7 pm will be held as per schedule, they said.

The last rites of Ratan Tata, who passed away late on Wednesday evening, are scheduled to take place after 4 pm at central Mumbai’s Worli on Thursday.

Tata breathed his last on Wednesday evening at a city hospital.