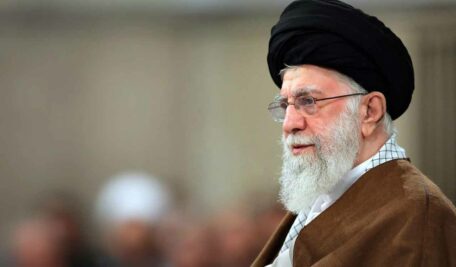

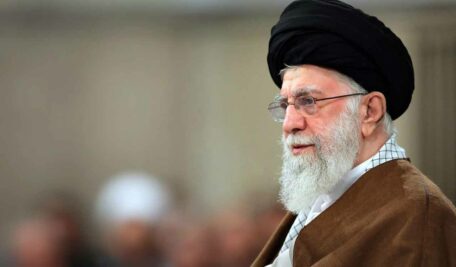

Iran’s Supreme Leader Ayatollah Khamenei warned of a crackdown as anti-government protests spread nationwide, chanting slogans against the regime and praising the former shah. Communication blackouts complicate reporting, while Trump reiterated US support for peaceful demonstrators

Published Date – 9 January 2026, 09:29 PM

Dubai: Iran’s supreme leader signalled Friday that security forces would crack down on protesters after they screamed from windows and marched through the streets overnight, directly challenging US President Donald Trump’s pledge to support those peacefully demonstrating.

Supreme Leader Ayatollah Ali Khamenei dismissed Trump as having hands “stained with the blood of Iranians” as supporters shouted “Death to America!” in footage aired by Iranian state television.

Protesters are “ruining their own streets to make the president of another country happy”, Khamenei said, referring to Trump. There was no immediate response from Washington, though Trump reiterated his pledge to strike Iran if protesters are killed.

Despite Iran’s theocracy cutting off the nation from the internet and international telephone calls, short online videos shared by activists purported to show protesters chanting against Iran’s government around bonfires as debris littered the streets in the capital, Tehran, and other areas into Friday morning. Iranian state media alleged “terrorist agents” of the US and Israel set fires and sparked violence. It also said there were “casualties”, without elaborating.

The full scope of the demonstrations couldn’t be immediately determined due to the communications blackout, though it represented yet another escalation in protests that began over Iran’s ailing economy and that has morphed into the most significant challenge to the government in several years. The protests have intensified steadily since beginning December 28.

The protests also represented the first test of whether the Iranian public could be swayed by Crown Prince Reza Pahlavi, whose fatally ill father fled Iran just before the country’s 1979 Islamic Revolution. Pahlavi, who called for the protests Thursday night, similarly has called for demonstrations at 8 pm Friday.

Demonstrations have included cries in support of the shah, something that could bring a death sentence in the past but now underlines the anger fuelling the protests that began over Iran’s ailing economy.

So far, violence around the demonstrations has killed at least 42 people while more than 2,270 others have been detained, said the US-based Human Rights Activists News Agency.

“What turned the tide of the protests was former Crown Prince Reza Pahlavi’s calls for Iranians to take to the streets at 8 pm on Thursday and Friday,” said Holly Dagres, a senior fellow at the Washington Institute for Near East Policy. “Per social media posts, it became clear that Iranians had delivered and were taking the call seriously to protest in order to oust the Islamic Republic.” “This is exactly why the internet was shut down: to prevent the world from seeing the protests. Unfortunately, it also likely provided cover for security forces to kill protesters.”

When the clock struck 8 pm Thursday, neighbourhoods across Tehran erupted in chanting, witnesses said. The chants included “Death to the dictator!” and “Death to the Islamic Republic!” Others praised the shah, shouting: “This is the last battle! Pahlavi will return!” Thousands could be seen on the streets before all communication to Iran cut out.

“Iranians demanded their freedom tonight. In response, the regime in Iran has cut all lines of communication,” Pahlavi said. “It has shut down the Internet. It has cut landlines. It may even attempt to jam satellite signals.” He went on to call for European leaders to join US President Donald Trump in promising to “hold the regime to account.” “I call on them to use all technical, financial, and diplomatic resources available to restore communication to the Iranian people so that their voice and their will can be heard and seen,” he added. “Do not let the voices of my courageous compatriots be silenced.” Pahlavi had said he would offer further plans depending on the response to his call. His support of and from Israel has drawn criticism in the past — particularly after the 12-day war Israel waged on Iran in June. Demonstrators have shouted in support of the shah in some demonstrations, but it isn’t clear whether that’s support for Pahlavi himself or a desire to return to a time before the 1979 Islamic Revolution.

The internet cut also appears to have taken Iran’s state-run and semiofficial news agencies offline as well. The state TV acknowledgment at 8 am Friday represented the first official word about the demonstrations.

State TV claimed the protests saw violence that caused casualties but did not elaborate. It also said the protests saw “people’s private cars, motorcycles, public places such as the metro, fire trucks and buses set on fire.”

Trump renews threat

Iran has faced rounds of nationwide protests in recent years. As sanctions tightened and Iran struggled after the 12-day war, its rial currency collapsed in December, reaching 1.4 million to USD 1. Protests began soon after, with demonstrators chanting against Iran’s theocracy.

It remains unclear why Iranian officials have yet to crack down harder on the demonstrators. Trump warned last week that if Tehran “violently kills peaceful protesters,” America “will come to their rescue.” In an interview with talk show host Hugh Hewitt aired Thursday, Trump reiterated his pledge.

Iran has “been told very strongly, even more strongly than I’m speaking to you right now, that if they do that, they’re going to have to pay hell,” Trump said.

Trump demurred when asked if he’d meet with Pahlavi.

“I’m not sure that it would be appropriate at this point to do that as president,” Trump said. “I think that we should let everybody go out there, and we see who emerges.” Speaking in an interview with Sean Hannity aired Thursday night on Fox News, Trump went as far as to suggest 86-year-old Supreme Leader Ayatollah Ali Khamenei may be looking to leave Iran.

“He’s looking to go someplace,” Trump said. “It’s getting very bad.”